President Joe Biden (Picture by Ethan Miller/Getty Visuals)

President Joe Biden is thinking about pupil mortgage forgiveness by executive get.

Here’s what you want to know.

College student Loans

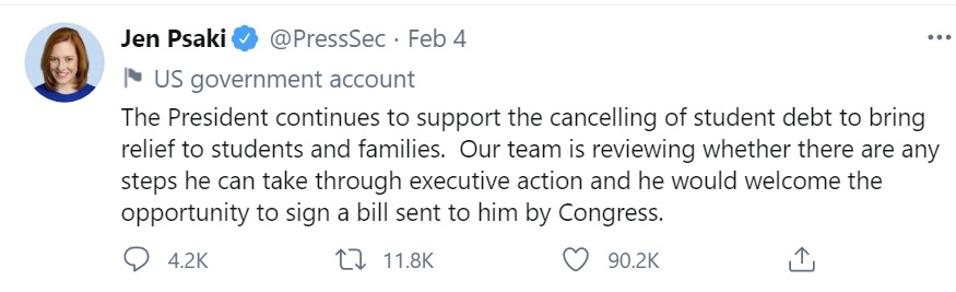

The White Property claims that Biden supports pupil financial loan cancellation, and would continue on to critique no matter whether he can provide university student loan forgiveness by way of government action. “The President continues to guidance the cancelling of student debt to convey reduction to students and family members,” White Household Push Secretary Jen Psaki tweeted. “Our group is examining no matter if there are any steps he can get as a result of government motion and he would welcome the possibility to indicator a bill despatched to him by Congress.”

University student loan forgiveness by executive order

Psaki’s tweet arrived hours just after she said in the course of a White Residence press briefing that “[the president] would seem to Congress to take the future actions [on student loan forgiveness].” Psaki also observed that Biden has postponed college student loan payments for 8 months through September 30, 2021, which furnished university student loan reduction to almost 40 million Us residents. The tweet is clear that when the administration will evaluation possible avenues for student mortgage cancellation by way of government action, Biden prefers to indicator a monthly bill that Congress passes.

Democrats system $50,000 of pupil bank loan cancellation

Sen. Elizabeth Warren (D-MA) and Senate Bulk Chief Chuck Schumer (D-NY) are renewing their resolution in Congress that calls on Biden, via govt purchase, to cancel up to $50,000 of student loans for university student financial loan borrowers. Importantly, their proposal doesn’t imply that all people will get student financial loan forgiveness. Rather, only pupil mortgage debtors with federal college student financial loans who gain fewer than $125,000 would be suitable. Supporters say that student bank loan cancellation will encourage the economic system, lower disparity, increase spouse and children development, persuade new businesses, make improvements to retirement cost savings, spur homebuying, among the other added benefits.

Authority for pupil loan cancellation

According to Warren and Schumer, the Bigger Instruction Act of 1965 supplies lawful authority for the U.S. Secretary of Education and learning to cancel student financial loans. They reference Section 432(a) of the Higher Education Act, which grants the U.S. Secretary of Schooling the authority “to modify, compromise, waive, or launch any suitable, title, assert, lien, or demand from customers, even so acquired, which includes any equity or any ideal of redemption.” Based on this provision, they argue that it’s unquestionable that the president (by way of the Secretary of Education) can cancel pupil financial loans for all university student financial loan debtors.

Will your pupil financial loans get cancelled?

Will your university student financial loans get cancelled? To start with, there’s no assurance that your college student financial loans get cancelled. This consists of by Congress or the president. Although the Biden administration suggests it will evaluation possible avenues for pupil personal loan cancellation, it’s apparent that Biden nonetheless prefers Congress to cancel college student financial loans. It’s not like the Biden administration has not reviewed its authorized authority for university student loan forgiveness. On the contrary, Biden has previously referenced he likely does not assume a president has the unilateral authority to enact widescale scholar personal loan forgiveness via executive motion. Usually, the legislative branch, not the govt branch, has the authority to approve federal paying out, and university student bank loan cancellation would drop in this class. Even though the Secretary of Education can terminate college student loans in specified situations such as fraud or overall and permanent disability, it’s significantly less likely that the Instruction Secretary unilaterally can terminate hundreds of billions of pounds of college student financial loans for 40 million men and women at after.

Biden needs student financial loans cancelled promptly. The critical issue is why Democrats aren’t cancelling student loans by means of the legislative course of action. Whilst some believe that it’s attainable Biden can cancel college student loans via govt action, it’s unquestionable that Congress — which Democrats regulate — can terminate college student financial loans. If it’s an important priority, why not deliver college student personal loan cancellation for a vote? Congress could pass standalone laws, involve college student bank loan cancellation in a stimulus bundle, or as Sen. Bernie Sanders (I-VT) has championed, go pupil financial loan forgiveness this way.

As a substitute, Warren and Schumer, who represent the progressive arm of Democrats in Congress, are pressuring Biden, a member of their have political social gathering. Republicans in Congress won’t support scholar financial loan cancellation, but Biden may possibly not be capable lawfully — even just after additional inner overview — to forgive pupil financial loans. If that is the circumstance, what is the match approach? Possibly it is more successful to craft laws that Congress can conceivably pass. This would have to have get the job done on how considerably college student bank loan forgiveness and who qualifies. Even if Biden is somehow able to terminate college student loans for thousands and thousands of debtors through the stroke of a pen (which is not anticipated), he’s not likely to cancel everyone’s scholar financial loans, or even $50,000 of scholar loans. Democrats would be greater served by uniting on a pupil bank loan cancellation strategy, fairly than perpetuate tacit intra-social gathering battling. Biden has proposed to terminate scholar loans a few strategies. In addition to large-scale, upfront student personal loan forgiveness, Congress also can get the job done on laws to tackle these other regions of university student personal loan cancellation. Devoid of a clear approach outside of pressuring the president, it’s unclear regardless of whether university student mortgage cancellation will turn out to be regulation. That’s potentially lousy information for college student mortgage debtors. So, in the suggest time, make positive you have a college student financial loans sport prepare. Start out with these a few selections, all of which have no costs: